Christmas Care Donation 2022

Graham Scott Enns LLP is looking to hire an accounting co-op student for the Spring 2023 work term. If you are looking for a new challenge and are excited to join a team of hard-working professionals, we would love to hear from you! Please refer to https://www.grahamscottenns.com/about-us/careers/ to learn more about this and other exciting employment opportunities!

Graham Scott Enns LLP would like to congratulate all successful CFE writers on their incredible accomplishment!

We are proud to acknowledge our own successful writers Nick Boyer, Jackson McCully and Jason Rakowicz who have completed this incredible career milestone. Congrats!!

This year, after two years of gathering virtually, the Staff and Partners at Graham Scott Enns gathered together and participated in our annual Halloween Costume Contest and food drive!

To help raise donations for the local food bank, the staff and partners at GSE had to contribute:

1 can for each person participating in the contest

2 cans for each person no participating, or

3 cans for anyone dressed up as an accountant

The contestants off their costumes, and everyone had the chance to vote for their favourites to win a prize! Congratulations to this year’s winner, Tara Lethbridge, who dressed up as a scarecrow.

On behalf of everyone here at GSE, we wanted to wish everyone a safe and Happy Halloween!

Graham Scott Enns LLP is looking to add the role of File Preparation Technician to our growing team in Aylmer. If you are looking for a new challenge and are excited to join a team of hard-working professionals, we would love to hear from you! Please refer to Career Opportunities | Graham Scott Enns to learn more about this and other exciting employment opportunities!

Are you an aspiring female or non-binary entrepreneur? If the answer is yes, you may be eligible for a loan of up to a maximum of $50,000 through the Women’s Enterprise Organizations of Canada (WEOC) National Loan Program. Please visit Loan Program – Women’s Enterprise Organizations of Canada (weoc.ca) for more information.

Women Entrepreneurship Loan Fund: Women Entrepreneurship Loan Fund (canada.ca)

Women’s Enterprise Organization of Canada: Home – Women’s Enterprise Organizations of Canada (weoc.ca)

The Health and Wellness committee at Graham Scott Enns LLP would like to congratulate and thank everyone who took part in The Railway City Road Races on September 25, 2022. The weather certainly did not cooperate, but as they say, it takes rain to make flowers grow and having the determination to run in the rain certainly builds character. GSE would like to give a special mention to Erin, Riley, Lucas, Emma and Oliver (children of GSE Partners and staff members) who also braved the weather to take part in the event.

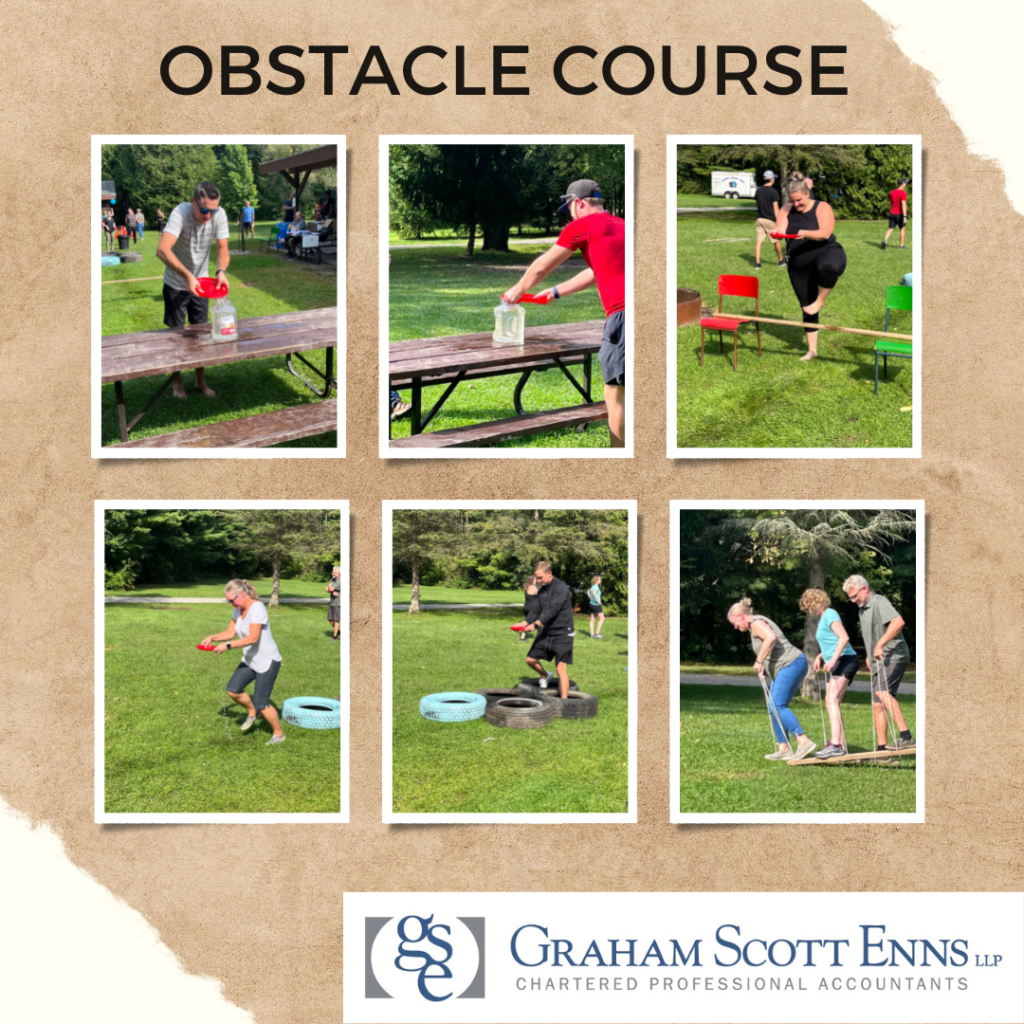

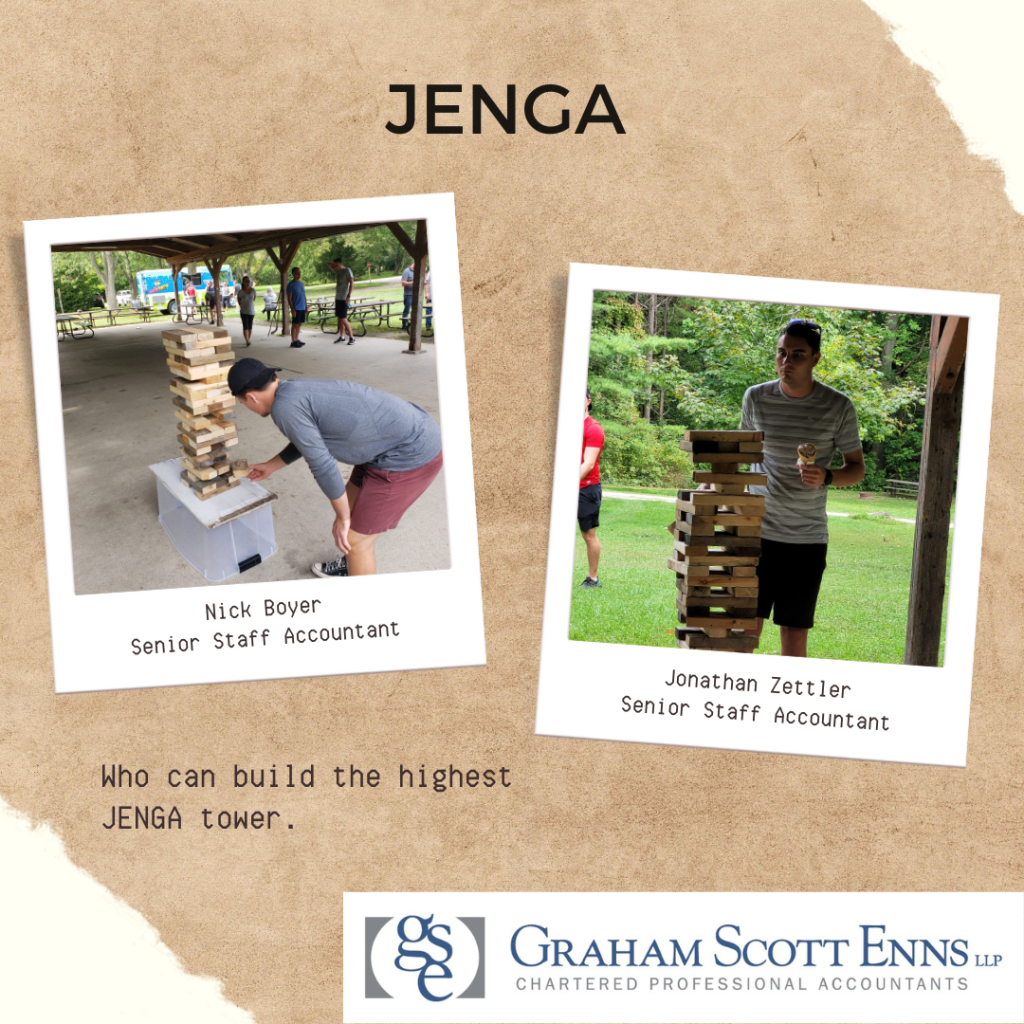

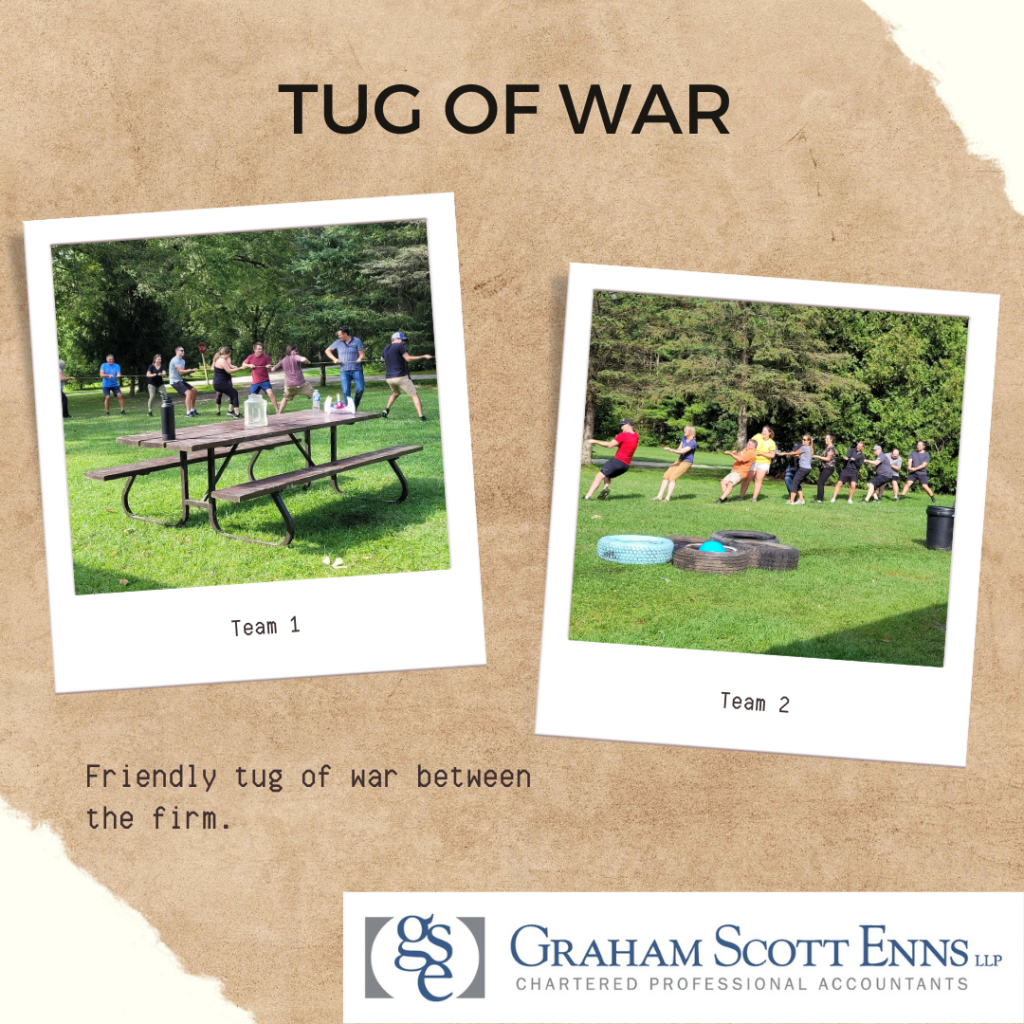

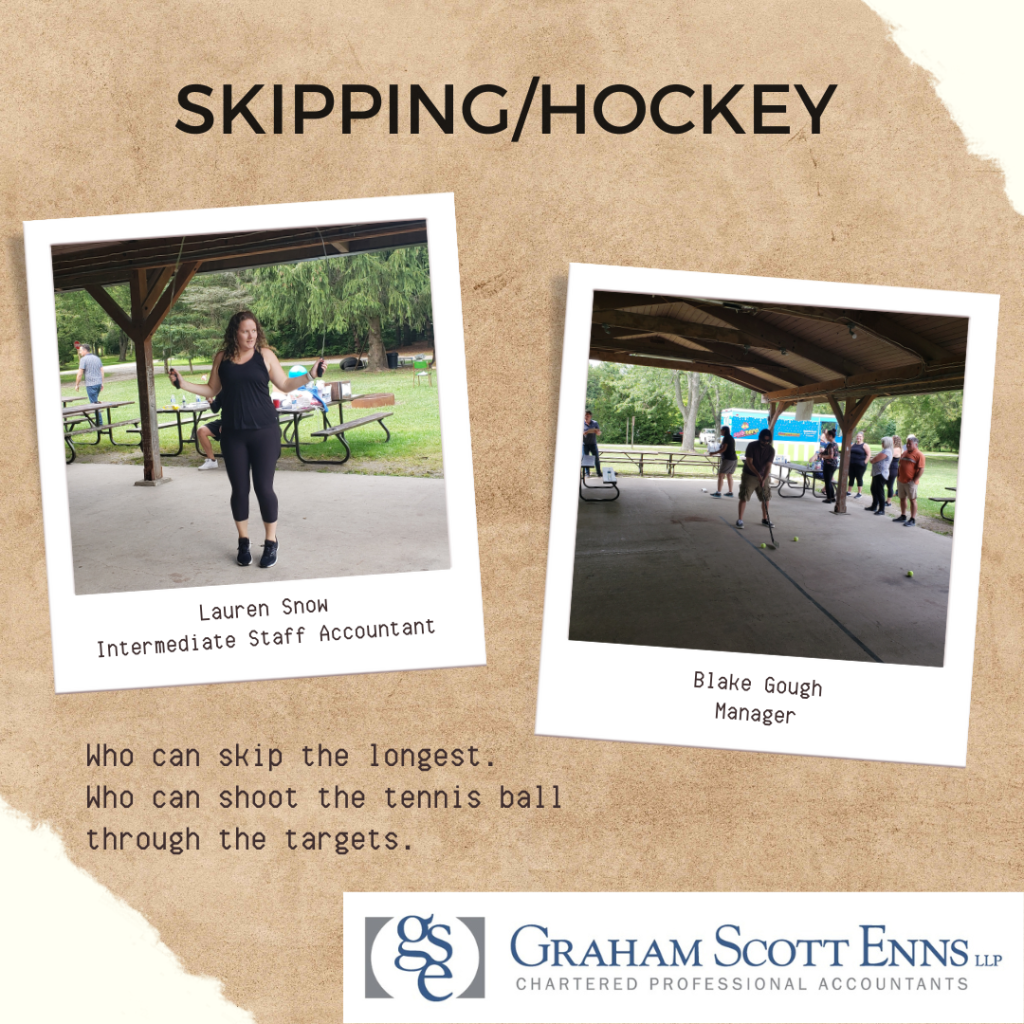

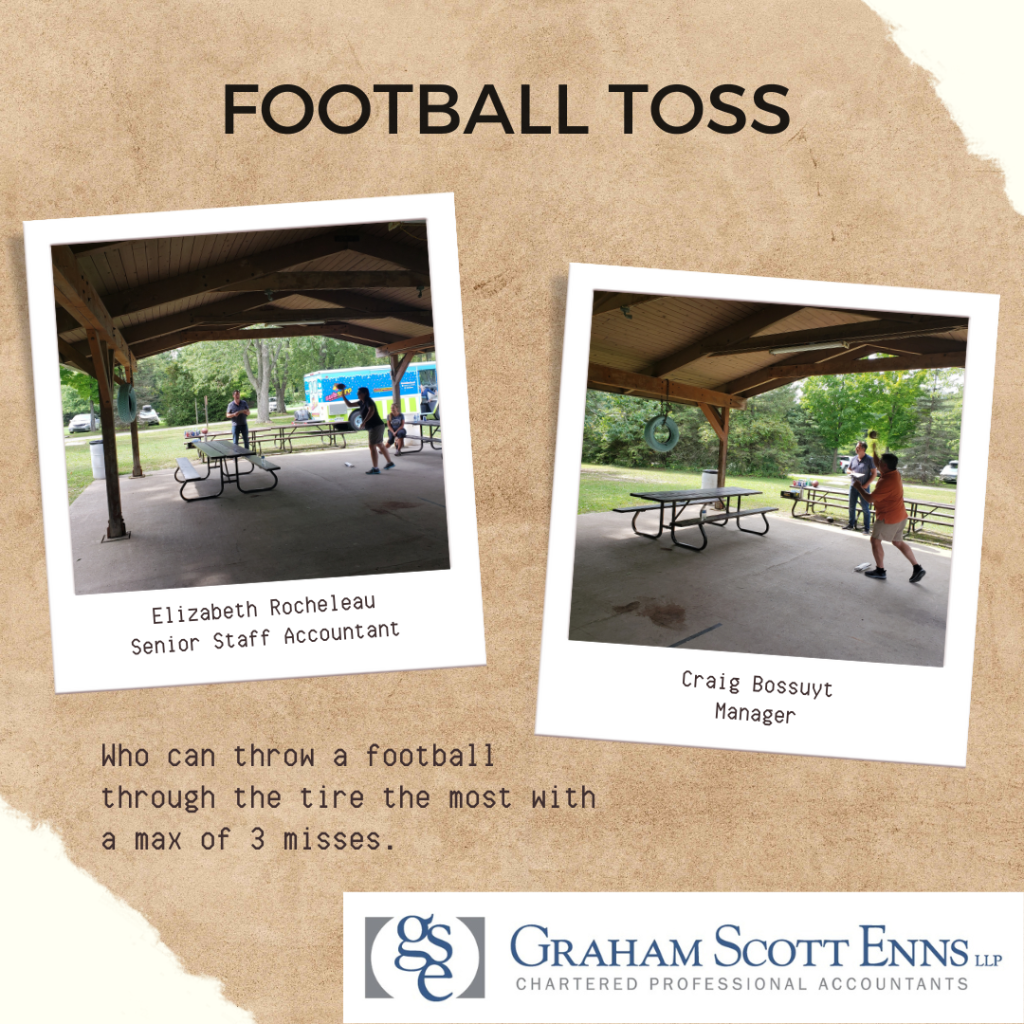

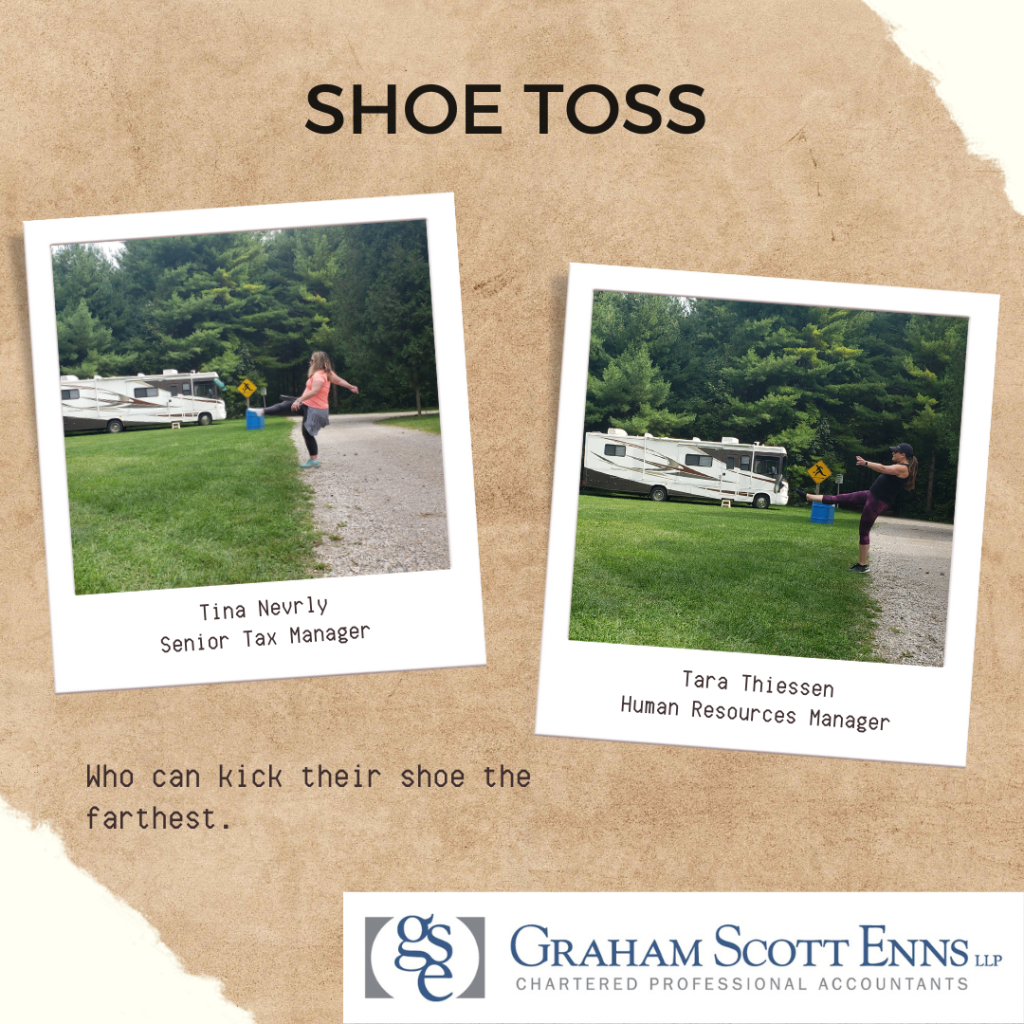

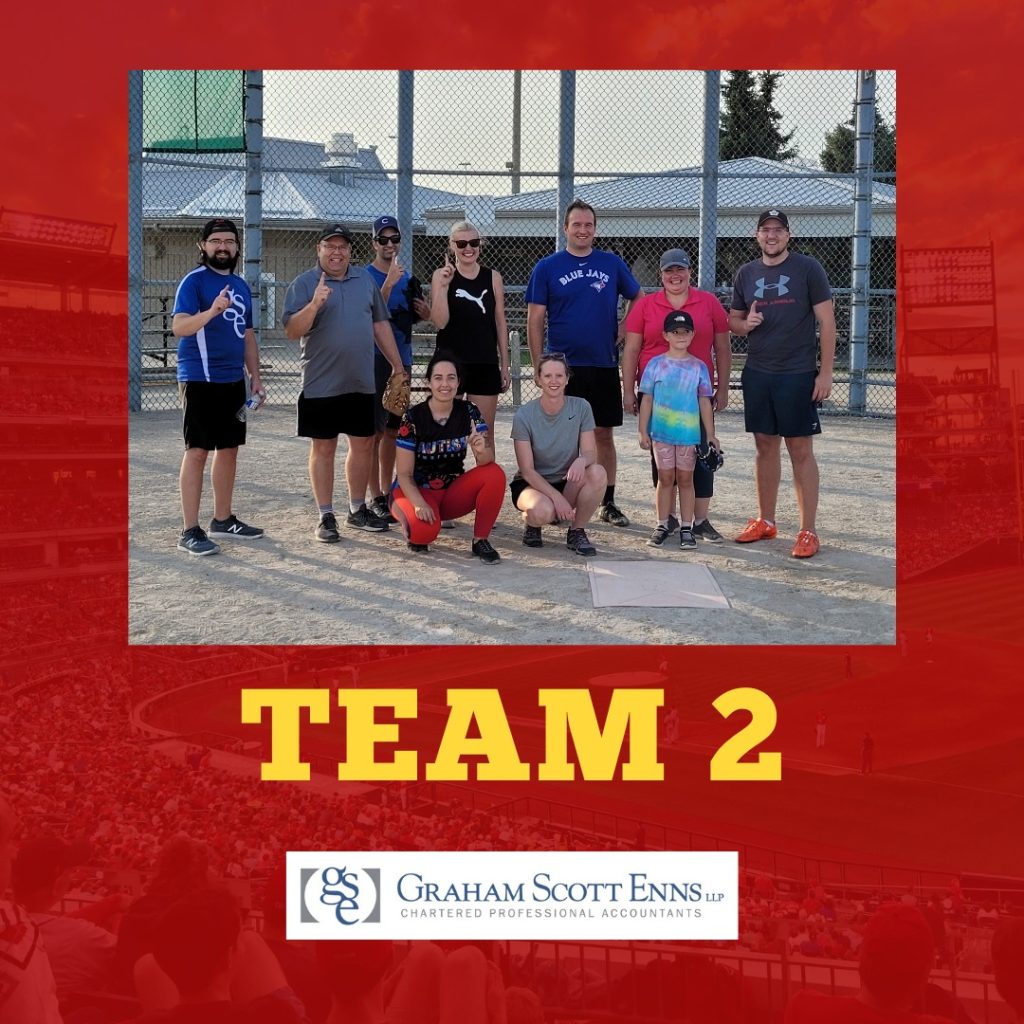

On Tuesday September 20th, 2022, GSE held its 2nd annual Picnic and Games Day at Springwater Conservation Area in Aylmer. The afternoon consisted of a delicious BBQ lunch provided by The Smokin’ Caboose Barbeque, individual games, team games, a 30-minute trail hike and an ice cream treat provided by the Subzero food truck. At GSE, we take great pride in building a strong, cohesive work culture through involvement in team building events.

Today is Back to School Day! In order to help make today the #bestfirstday, the Staff and Partners at Graham Scott Enns have collected school supplies to help out the Thames Valley Education Foundation with their annual back to school drive.

A big Thank You to Courtney, and the rest of the Social Committee, for organizing, shopping, and dropping off this donation!