RRSP Contribution Deadline: March 1, 2023

Graham Scott Enns LLP is pleased to announce that we have added a new member to our GSE team! Bailey Sloetjes started with the firm December 2022 as a File Preparation Technician. Bailey previously worked at GTEL as a dispatch assistant. She attended the University of Windsor where she received a Bachelor of Computer Science degree. Bailey took many accounting classes in high school which she enjoyed, so she is looking forward to exploring the accounting industry in her new role at GSE!

Welcome to GSE Bailey!

If you would like to learn more about working at GSE, please visit our Career page for more information about our career opportunities.

The Partners and Staff of Graham Scott Enns LLP would like to congratulate Courtney Vachon, CPA, CGA, on her promotion to Senior Manager, effective January 1, 2023!

Courtney began her employment at GSE in 2016 after previously working at a national public accounting firm. Courtney provides high quality assurance, compilation and tax compliance services to a wide range of owner managed business clients and not-for-profit organization clients. Courtney is a valued member of our Manager group and is passionate about training and mentoring staff members.

“Beyond Courtney’s work with our clients, she is a leader within our firm and mentors many firm members. Courtney understands that training is integral to our success and ensures she spends the time working with other firm members to achieve high quality work. Courtney is a long-time member of GSE’s Social Committee and, in particular, takes the lead on many of the firm’s charity donation drives during the year – she is a strong supporter of our local community and encourages all of us to do our part!”

Mike Stover, CPA, CA

Partner

Congratulations Courtney on your well-deserved promotion to Senior Manager!

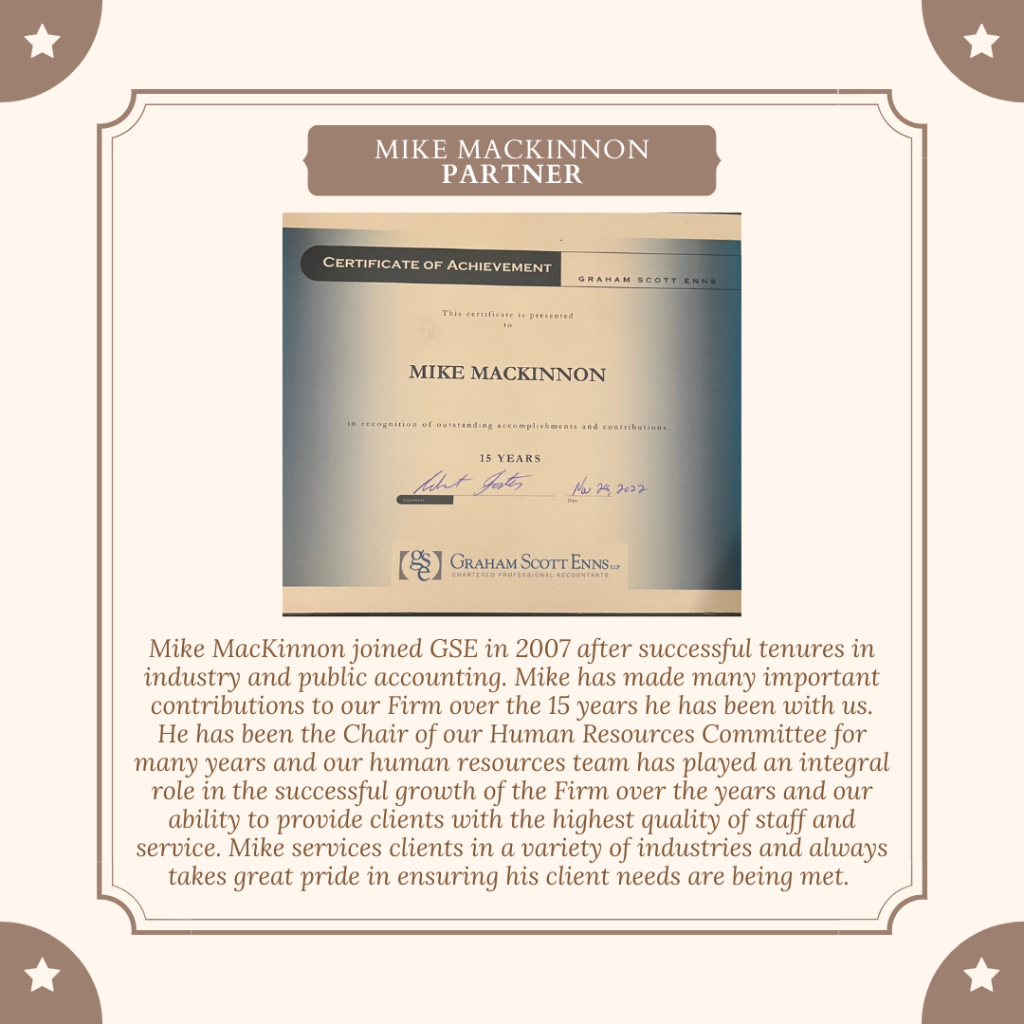

On December 19th, 2022, GSE firm members gathered together for a holiday lunch at New Sarum Diner. Partners and staff enjoyed a delicious holiday turkey lunch to bring on the festive spirit. At lunch, GSE had the opportunity to recognize some important career milestones for individual firm members. Please scroll through the photos to view the years of service milestones for each individual firm member that was recognized at the lunch.

As always, we would like to thank the Social committee for organizing the lunch and for New Sarum Diner’s great hospitality!

Happy Holidays Everyone!!

\

\

\ ]

]

GSE will be closed for the holidays the week of December 26th to December 30th. The St. Thomas office will reopen on January 2nd, 2023 with normal business hours, 8:30am – 5:00pm. Please note that the doors to the County of Elgin building and drop box are only available 8:30am – 4:30pm daily.

The Aylmer office will reopen on January 2nd, 2023 with normal business hours, 8:30 – 5:00pm.

During the period from December 26th, 2022 to January 2nd, 2023 both offices will be closed to the public with no access to the drop boxes.

Seasons Greetings!

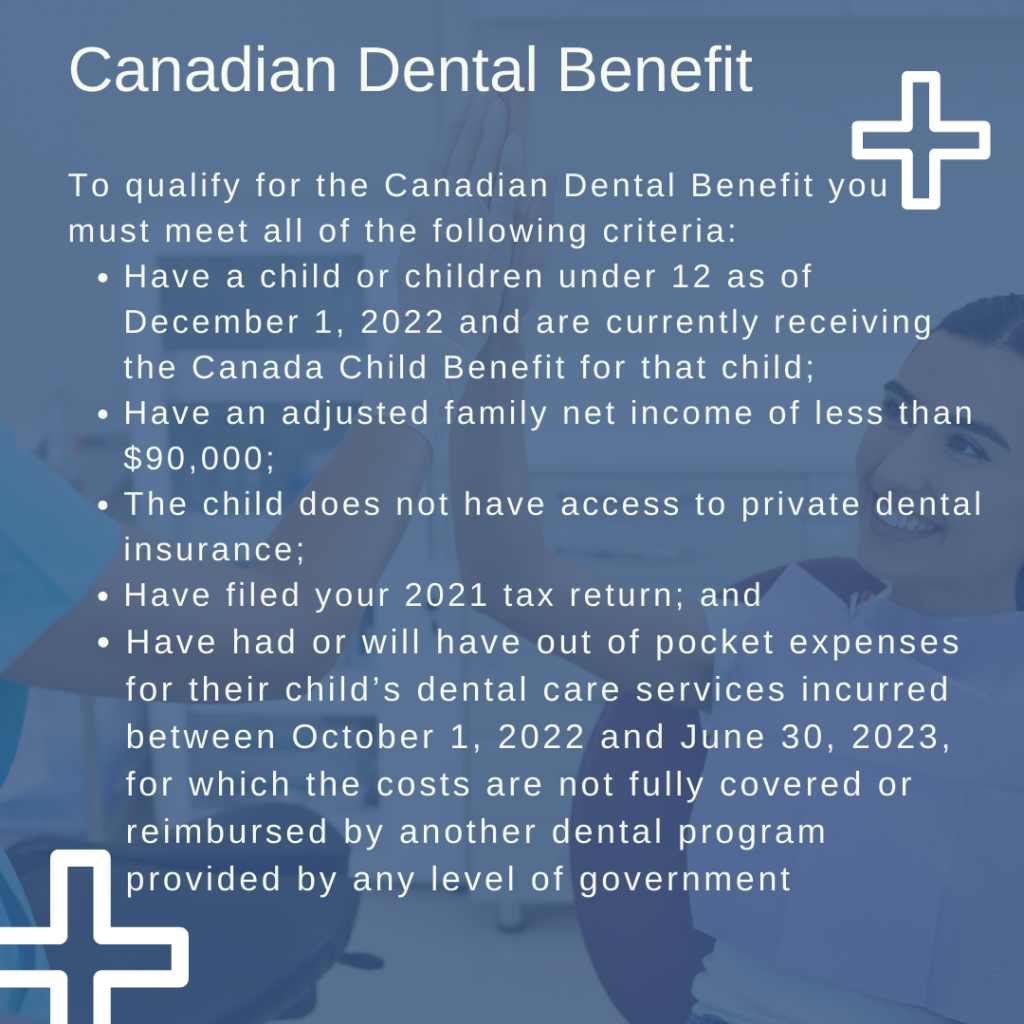

Do you have a child under the age of 12? If so, you may qualify for the Canadian Dental Benefit!

This benefit will give eligible families up-front, direct payments of up to $650 a year per eligible child under 12 for two years to help cover the costs of dental care services.

Payments will range between $260 and $650, depending on the adjusted net income. This payment will be tax free, and available for each eligible child, for two periods. The first period is for children under 12 as at December 1, 2022 who had dental care between October 1, 2022 and June 30, 2023.

Full criteria include:

More information on the Canada Dental Benefit can be found here: Canada Dental Benefit – Canada.ca

Graham Scott Enns LLP is looking to hire an accounting co-op student for the Spring 2023 work term. If you are looking for a new challenge and are excited to join a team of hard-working professionals, we would love to hear from you! Please refer to https://www.grahamscottenns.com/about-us/careers/ to learn more about this and other exciting employment opportunities!

Graham Scott Enns LLP would like to congratulate all successful CFE writers on their incredible accomplishment!

We are proud to acknowledge our own successful writers Nick Boyer, Jackson McCully and Jason Rakowicz who have completed this incredible career milestone. Congrats!!