Graham Scott Enns LLP would like to congratulate all successful CFE writers on their incredible accomplishment!

We are proud to acknowledge our own successful writers Nick Boyer, Jackson McCully and Jason Rakowicz who have completed this incredible career milestone. Congrats!!

Blog | News

Tax Tips & Traps – 4th Quarter 2022 – Issue 140

Highlights In This Issue:

- Tax Tidbits

- Crowdfunding: Taxable or Not?

- Trusts: New and Expanded Disclosure Requirements

- Director Liability: Is Asking About Source Deductions Enough?

- Executor: Whether to Accept this Role

- GST/HST Input Tax Credits: Reasonable Expectation of Profit

- Tips Collected Electronically: Withholding Requirements

Loans of Up to $50,000 to Women Entrepreneurs

Are you an aspiring female or non-binary entrepreneur? If the answer is yes, you may be eligible for a loan of up to a maximum of $50,000 through the Women’s Enterprise Organizations of Canada (WEOC) National Loan Program. Please visit Loan Program – Women’s Enterprise Organizations of Canada (weoc.ca) for more information.

Women Entrepreneurship Loan Fund: Women Entrepreneurship Loan Fund (canada.ca)

Women’s Enterprise Organization of Canada: Home – Women’s Enterprise Organizations of Canada (weoc.ca)

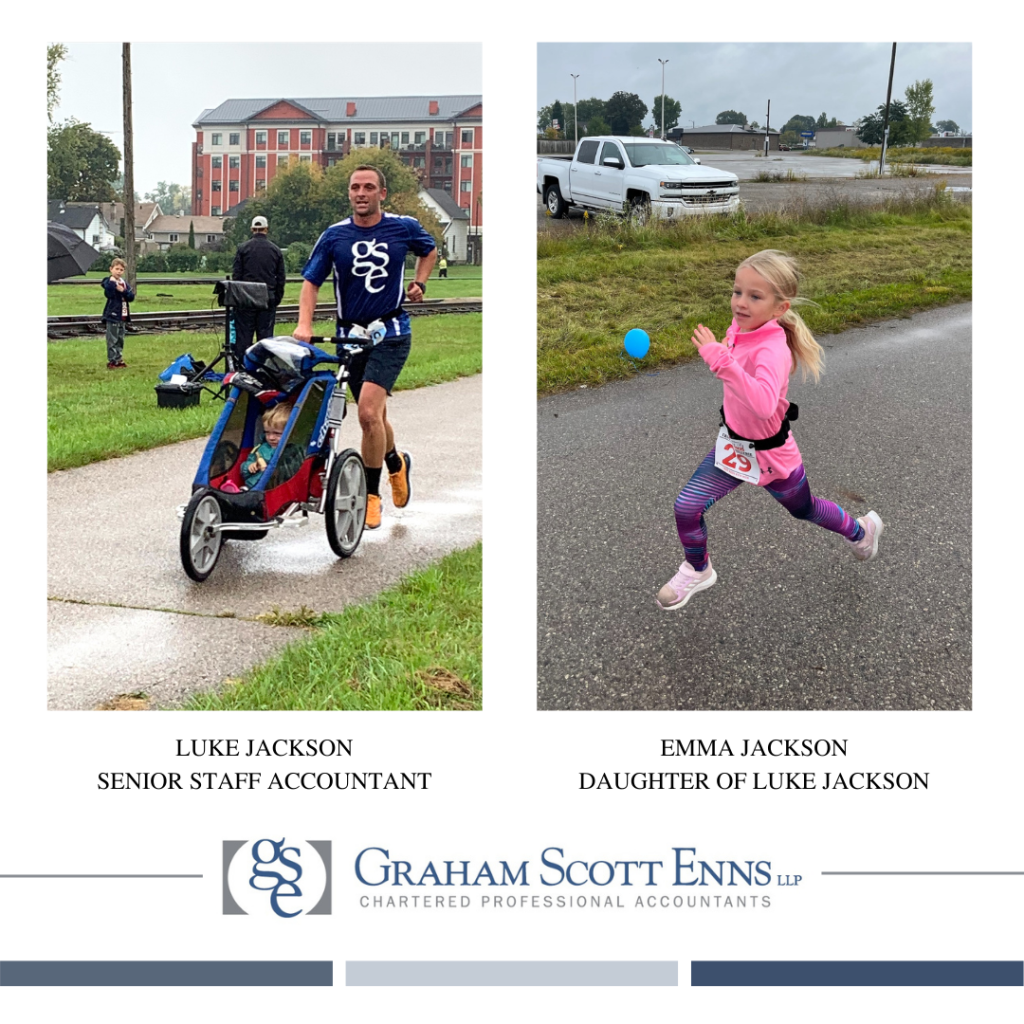

Railway City Road Races

The Health and Wellness committee at Graham Scott Enns LLP would like to congratulate and thank everyone who took part in The Railway City Road Races on September 25, 2022. The weather certainly did not cooperate, but as they say, it takes rain to make flowers grow and having the determination to run in the rain certainly builds character. GSE would like to give a special mention to Erin, Riley, Lucas, Emma and Oliver (children of GSE Partners and staff members) who also braved the weather to take part in the event.

Tax Tips & Traps –3rd Quarter 2022 – Issue 139

Highlights In This Issue:

- Tax Tidbits

- Poker Playing: Hobby or Business?

- Required Travel: Between Home and Work

- Principal Residence Exemption: Land in Excess of One-half Hectare

- Personal Services Business (PSB): CRA Education Initiatives

- TFSA Overcontribution: Information in Your CRA Online Account

- CPP Disability Benefit: Following the Doctor’s Advice

- Shared Custody Arrangements: Impact of School Closures

Tax Tips & Traps – 2nd Quarter 2022 – Issue 138

Highlights:

Tax Tidbits

Buying and Selling a Home: Budget 2022

Principal Residence Exemption

CERB/CRB: Eligibility Verification

Estimated Sales by CRA: Audit File Selection and Assessment

Auditing Old Tax Returns: CRA Abilities and Limitations

Money Received from Abroad: CRA Reviews

Digital Adoption Program: Grants, Loans and Professional Assistance

Tax Party 2022

This past Monday marked the end of Personal Tax Season for us at Graham Scott Enns LLP. GSE marked the occasion with our usual end of tax season party. This year, we held our tax party at the wonderful Wildflowers Farm in St. Thomas. It was a great opportunity to socialize outside of the workplace and de-stress after a busy few months. There were lots of games, good food and great company. We’ve missed the opportunity to gather as a large group over the last two years, so we all enjoyed the opportunity to spend time together. A big thank you to Wildflowers Farm for hosting our party!

2022 Federal Budget Commentary

Tax Highlights of the April 7th 2022 Federal Budget Commentary Include:

A. Personal Measures

B. Business Measures

C. International Measures

D. Sales and Excise Tax

E. Retirement Plans

F. Charities Measures

G. Previously Announced Measures

Read the full article below.

Congratulations Jonathan!

The Partners and Staff of Graham Scott Enns LLP would like to congratulate Jonathan Zettler on his promotion to Senior Staff Accountant, effective January 1, 2022!

Jonathan started with GSE as a co-op student in 2019. He then started full time a year later, in 2020, and has been an integral part of the GSE team, focusing on bookkeeping and payroll. Jonathan is currently working towards his Payroll Compliance Practitioner certification, where he can continue to put his payroll skills to great use! He is also highly involved in personal taxes, and compilation engagements, as well as a member of our Health and Wellness Committee.

“Jonathan provides excellent client service and is able to provide guidance on payroll, bookkeeping and personal tax questions. Jonathan embodies professionalism, diligence and technical excellence.”

Courtney Vachon, CPA, CGA & Kelly Ward, CPA, CGA

Managers

Congratulations Jonathan of your promotion to Senior Staff Accountant, and best of luck as you take on this new and exciting opportunity!

GSE Attends Night of Heroes!

Last night GSE staff and Partners attended the 30th Annual Community Living London Night of Heroes! It was an inspiring event full of fun and fashion to celebrate an incredible cause!

Although they could not hold the event in person, it was still fun to watch together virtually and support all of the Heroes!